I can say that most of the calls to my firm involve significant and complex child custody issues, many involving psychological issues or parental alienation concerns. Yet, it is still very important for my practice to focus on financial issues in divorce, as well. Issues concerning support calculations, and valuation issues of real estate and/or business are an important and essential part of the practice. I spent a few years, along with my law school training, in MBA school as well. These years of the study of accounting and finance have proven beneficial in the practice of Illinois Divorce Law.

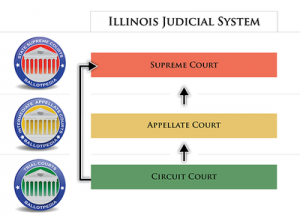

A case I tried some years ago made its way to the Appellate Court in Illinois. The case was ultimately brought to the Illinois Supreme Court, which decided not to address the Third District Appellate Court’s decision in Marriage of Liszka. I tried the Liszka case before a Will County judge, and it was a barnburner, involving both child custody issues and financial issues including the valuation of a closely held business worth in the millions of dollars.

Part of my approach with the trial court in that case was to ask the Court to not only value the retained earnings in the business as marital property, but as these retained earnings had not been part of the valuation of the business, that the Court should distribute the marital earnings to the parties as a cash distribution of marital property. The trial court declined to do so. Fortunately, because the case was tried with some expectation that the court might make some mistakes in its judgment of the case, I tried the case with an eye that the decision of the court would be appealed.

In re Marriage of Liszka, 2016 IL App (3d) 150238

A. Retained Earnings Retained earnings are marital property. In re Marriage of Lundahl, 396 Ill. App. 3d 495, 504 (2009). Here, the evidence showed that ISP had no retained earnings in 2011, the year of Zouzias’s valuation of ISP. However, ISP may have had retained earnings in 2013. On remand, when the parties present evidence of the value of ISP, they should also present evidence regarding the existence and amount of retained earnings of ISP in any year after 2011 until the date of dissolution. If retained earnings exist and are not included in the new valuations of ISP, they should be divided between the parties.

Practice pointer: Understanding business valuations, as well as corporation accounting, allowed me to try the case with some measure of precision, and this allowed the appellate court to correct the errors of the trial court in this case. The result? Many more dollars awarded to my client.

Illinois Divorce Lawyer Blog

Illinois Divorce Lawyer Blog