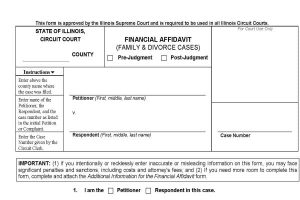

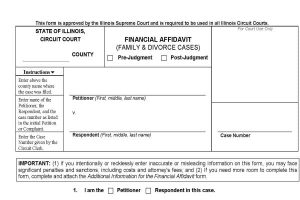

In Illinois, divorcing parties fill out a Financial Affidavit statewide form to provide a clear and comprehensive snapshot of their financial situation during the divorce process. This form is a standardized document that helps promote transparency and fairness when it comes to dividing assets, determining spousal support (alimony), and, if applicable, calculating child support. Illinois law imposes legal duties on parties to complete the form truthfully and to make full disclosures of income, expenses assets and liabilities.

The affidavit requires each party to disclose details about their income, expenses, debts, and assets. This information is crucial because Illinois follows an “equitable distribution” approach to dividing marital property, meaning assets and debts are split in a way that’s deemed fair, though not necessarily equal. The financial affidavit gives the court—and the attorneys involved—a factual basis to make informed decisions about what’s equitable based on each spouse’s financial circumstances.

It’s also tied to Illinois law, specifically the Illinois Marriage and Dissolution of Marriage Act, which mandates full financial disclosure to prevent either party from hiding assets or income. Without this form, it’d be harder to verify claims about financial need or ability to pay support, which could drag out the process or lead to unfair outcomes.

Illinois Divorce Lawyer Blog

Illinois Divorce Lawyer Blog